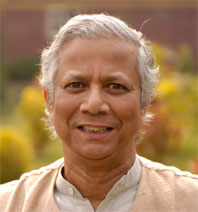

Muhammed Yunus has been awarded this year's Nobel Peace Prize for his work on "microcredits," and I can't think of a better candidate. The emerging microcredit industry represents nothing less than a revolution in approaches to economic development, one that holds more potential for bettering the lives of people throughout the underdeveloped world than anything yet proposed. Der Spiegel has a wonderfully illuminating article on these "barefoot bankers" and their approach to credit here. A few excerpts:

Microcredit, as it is called in industry jargon, is a ray of hope in the often dismal development scene....The loans are expensive -- the microbanks charge five to six percent interest per month -- but operating costs are high [in many places microbanks have to maintain and defend offices in every neighborhood so people will have a safe place to keep their earnings] and the rates, which to us seem exorbitant are far better than would be available from other sources.

Barefoot bankers have shown that the logic of capital markets works just as well with the poor as the rich. For those who still think of development work as a way of giving alms to the poor, this is provocative news. At the management level of most development organizations, the Sacred Heart approach is still the norm. Of course, most agree with the concept of helping people so that they can help themselves, but in practice few actually do it.

....

The poor people's banks... don't carry out credit checks or ask borrowers if they have any capital of their own. All that anyone who wants to take out a loan needs is a good idea and a permanent address. But there are no second chances for borrowers who waste the money....

Here's the revolutionary part:

It's a simple concept really. Instead of basing aid on the principle of need, as traditional development theory does, microcredit loans demand a sense of responsibility. Whereas aid is often given to those who have nothing with no expectation of repayment, tiny loans encourage creativity. And it seems to be working. Many banks that make such tiny loans have started to make a profit -- and private investors can buy shares. A shareholder can earn interest while also supporting a good cause.And there is the implicit possibility of a social revolution here too:

Interestingly, most of the borrowers are women. "They know how to handle money better, and they are more reliable than the men," [a specialist] says. The men favor the traditional African division of labor under which they have all the authority and the women must do the work."A society in which the women control the money is one in which women will soon exercise power.

This entrepreneurial model based on responsibility rather than need has chalked up a number of successes over the years and is finally being recognized by the international development community. Yunus' Nobel is one indication of that. So, too, are Paul Wolfowitz' new policies at the World Bank which put a premium on responsibility and anti-corruption programs. Not surprisingly many of the staffers at the Bank and figures on the Left have resisted Wolfowitz's reforms, but progress is being made.

No comments:

Post a Comment